Event Description

1. Background

ASEAN is recorded as the second fastest growing economy in Asia after China, presenting a huge potential for investment in coming years.[1] Along the formation of the ASEAN Economic Community (AEC) in 2015, the region becomes an integrated market across its member countries as well as the Asia Pacific countries particularly Australia, China, India, Japan, South Korean and New Zealand under the umbrella of trade deal known as the Regional Comprehensive Economic Partnership (RCEP). As a result, major Foreign Direct Investment (FDI) flow of ASEAN countries mainly come from regional expansion of multinational enterprises, investments in huge new connectivity projects and other transport infrastructures. Investment opportunities in ASEAN also exist across a wide range of industrial sectors, manufacturing sectors, agriculture, Information, Communication and Technology (ICT), education and health care. In addition to such opportunities, global investors are attracted with the advantage of low cost labor market especially in Cambodia, Lao PDR and Myanmar. Improving cross border linkages and regional connectivity envisaged under the AEC agendas like ASEAN Customs Single Window facilitate current growth of cross border trade and investment among member countries, which also help regional SMEs integrate into the regional and global supply chains.

United Nations Conference on Trade and Development (UNCTAD)’s world investment report 2017 shows that FDI flow to ASEAN countries was $101 billion in 2016. Despite a decline of FDI flow in Singapore, Malaysia and Thailand in 2016, most of Mekong Sub-Region countries remain performed well, namely Cambodia, Lao PDR, Myanmar and Vietnam (CLMV). These countries are well connected to each other via several economic corridors to enhance capacity in competitiveness and development of value chain networks. Moreover, unique advantages of each country offer opportunities for investors and attract FDI, for example; labor intensive works including agribusiness and natural resources in Cambodia and Myanmar and well-established industrial clusters in Thailand.[2]

However, large number of SMEs in the Mekong countries possesses limited knowledge on market information and commercial intelligence, leading to their inability to act as suppliers to foreign investors, and take advantage of the opportunities given. Furthermore, there is insufficient institutional support and assistance for the SME sector. Large number of SMEs, due to fragile internal stricture, cannot penetrate into the regional and global value chains. There are also limited opportunities for the SMEs to access to market, technology and innovation and skill development opportunities. The biggest challenges SMEs are facing in the Mekong counties under the era of AEC has been their capacity development and effective linkage with regional and global economy. In that case, the FDI to these countries plays a critical role of enhancing competitiveness of regional SMEs, fostering higher value added industrial clusters and promoting technology transfer to regional SMEs.

Therefore, Mekong Institute (MI) has supported the capacity development of selected SME clusters in 18 provinces along the Southern Economic Corridor (SEC) in CMTV through the project on “Enhancing Competitiveness of SMEs in the Southern Economic Corridor (SEC) of ASEAN Mekong Subregion (AMS).” The Project is funded by Japan - ASEAN Integration Fund (JAIF). In particular, the project supprots their linkage with regional and global economy through integration into regional and global value chains.

The MI also developed SEC business database (www.sec4business.com) as part of the Project. The database provides a business networking platform for SMEs in 18 provinces along the SEC in CMTV to access regional and global markets including Mekong region, ASEAN, east Asia and beyond and enhances trade and investment in their provinces. It also provides and enhances SMEs’ business outreach to investors through an effective information sharing mechanism with the latest trade and investment updates and technological support.

To further support the selected SME clsuters from the 18 SEC provinces in approaching investment opportunities, widening business linkages, and trade development for their integration into regional and global value chains, MI is organizing an Investor Forum and Business Matching 2017 in Bangkok, Thailand with the participation of prospective investors from Asian countries including Japan. For instance, Japan has identified the Mekong countries as a stable and profitable business partner. Growing number of Japanese enterprises are engaging in investment and trade coopertaion with Mekong countries, especially as part of “Thailand Plus One” movement. Investor Forum aims to provide opportunities for business matching and networking between selected SME clusters from 18 SEC provinces in CMTV and prospective investors from the Asian countries.

2. Objectives and Expected Outputs

The overarching objective of the Investor Forum and Business Matching 2017 is to promote the business linkages of SME clusters from 18 SEC provinces in CMTV with prospective investors and support their integrtaion into regional and global value chains.

In particular, the Investor Forum and Business Matching 2017 aims to:

- create opportunities to promote and increase the success of the selected SME clusters from 18 SEC provinces in CMTV in obtaining foreign investment in production development, and export markets;

- make the selected SME clusters’ products and business profiles successfully introduced to prospective investors for business development;

- assist the selected SME clusters with a better business interaction platform with which business cooperation, collaboration, and networking with prospective investors and businesses will be established and maintained.

3. Expected Outcomes

- At least 60 prospective investors and individual buyers, and SMEs participate in the investor forum and business matching;

- Initiated market linkages between the selected SME clusters and prospective investors from the region and beyond;

- At least 50% of project supported SME clusters establish new cooperation and collaboration for business development through business matching;

4. Program Description

|

4.1 |

Online Business Matching |

|

|

|

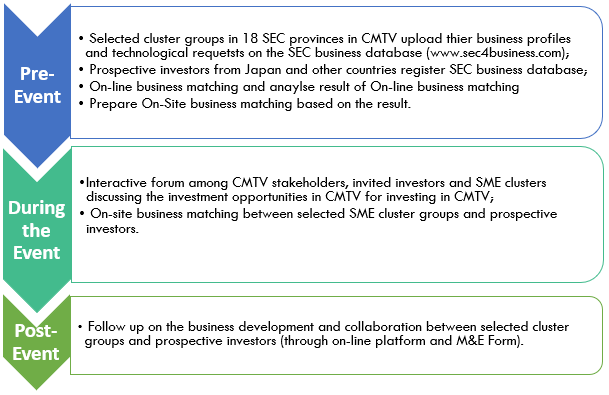

For preparation for Investor Forum and Business Matching 2017, selected clusters in 18 SEC Provinces in CMTV will upload their business profiles and technological requests in the SEC business database (www.sec4business.com). Based on the information uploaded, on-line business matching is organized between selected SME clusters and prospective investors from Japan. |

|

|

4.2 |

Investor Forum and Business Matching 2017 The Investor Forum and Business Matching 2017 is structured with two key parts:

|

|

|

|

|

|

|

|

It intends to have an interactive forum among invited investors, Cambodia, Myanmar, Thailand and Vietnam (CMTV) stakeholders and SME clusters discussing the investment opportunities and potential investors in CMTV.

Mr. Lee Yong Yong, Director, Community Affairs Directorate, Community and Corporate Affairs Department of the ASEAN Secretariat, will talk about current business opportunities in ASEAN with reference to the progress of ASEAN community building vis-à-vis ASEAN relationship with the dialogue partners. |

The session is a significant part of the event that provides an opportunity for the selected SME clusters and prospective investors to exchange investment potentials, and business matching for business networking and linkages.

SME clusters from 18 SEC provinces will showcase their products at Forum venue.

|

|

|

Key speakers from the region will share perspectives on emerging business opportunities, bottleneck and suggest ways and means to promote investment in the SEC in particular and Mekong countries in general. Experts from JETRO, HKDC etc will also share their insights. |

It will be arranged among selected SME clusters in 18 SEC provinces and prospective investors, in order for them to have business discussion and find customers / suppliers / other business partners.

Effectiveness of the Investor Forum and Business Matching 2017 will be monitored through business matching and M&E Forms. |

|

4.3 |

Monitoring, Evaluation, and Follow Up |

|

|

|

|

|

5. Steps of the event

5. SME Product Clusters

18 product clusters will exhibit their products to seek market opportunities for their products.

- Banteay Meanchey (Silk Production)

- Battambang (Fresh Water Fish Sauce)

- Kampong Chhnang (Pottery and Ceramics)

- Koh Kong (Sea Water Fish Sauce)

- Pursat (Pursat Orange)

- Preah Sihanouk (Dry Shrimp)

- Svay Rieng (Smach Rice)

- Kampot (Flower of Salt)

- Tanintharyi / Dawei (Mackerel Fish)

- Chanthaburi (Fresh Durian)

- Kanchanaburi (Banana Processing)

- Prachinburi (Organic Rice)

- Ratchaburi (Aromatic Coconut)

- Sa-Kaeo (Aromatic Herb)

- Trat (Community Based Tourism: CBT)

- Ca Mau (Dried Snakeskin gourami)

- Can Tho (Pangasius)

- Tay Ninh (Custard Apple)

A total of 36 participants from the selected SME clusters in 18 SEC provinces in CMTV (two from each province) are invited to participate in the Investor Forum and Business Matching 2017. Prospective Investors and other key stakeholders from Japan, Hong Kong and CMTV and the Project Steering Committee (PSC) members will also be invited to participate in the event. In addition to the project participants, invitation will be made to other Mekong institute supported projects beneficiaries in the region and also the partner organizations to participate in the event.

6. For Whom

- Participation is open to business owners from the SEC project provinces in Cambodia, Myanmar, Thailand and Vietnam and other Asian countries;

- Otagai Forum members and their representatives;

- Members of Foreign Business Associations in Thailand;

- Government agencies and Inter-governmental organizations;

- ASEAN Secretariat;

- Trade Promotion Agencies;

- Universities and other related institutions

7. Partner Organization (s)

The Investor Forum and Business Matching 2017 is organized by MI in collaboration with Otagai Forum Association. The roles and responsibilities of partner organization include (i) promoting Investor Forum and Business Matching 2017 to their members and partners; and (ii) invite their members and partners for on-line business matching through SEC business database and on-site business matching at the Forum.

8. Organizing Team and Contact

Mr. Madhurjya Kumar Dutta

Director, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Mr. Quan Anh Nguyen

Program Specialist, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Mr. Sa-nga Sattanun

Program Manager, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Mr. Toru Hisada

Senior Project Coordinator, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Ms. Wen Hao

Program Coordinator, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Mr. Ronnarit Chaiyo - Saeng

Program Officer, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

Mr. Kyaw Min Tun

Program Officer, Trade and Investment Facilitation (TIF) Department, Mekong Institute (MI)

For details, please contact:

|

Mr. Toru Hisada

|

Mr. Kyaw Min Tun

|

[1] Current situation of Mekong Sub-region, METI (2015). Retrieved from www.meti.go.jp/english/press/2015/pdf/0824_03a.pdf on October 06, 2017.

[2] Investing in ASEAN 2017, Allurentis (2017). Retrieved from www.allurentis.com on October 06,2017.